MOBILE BANKING

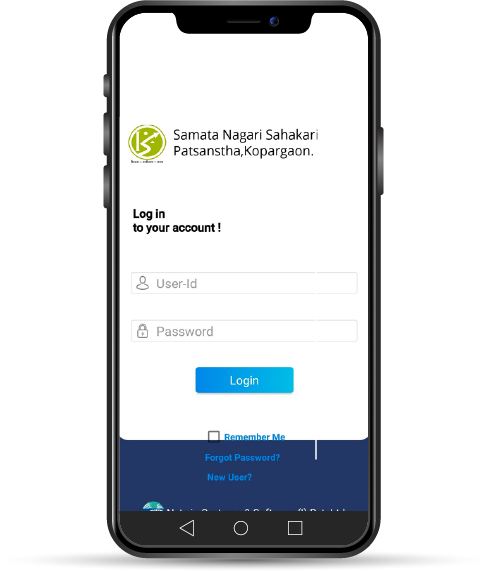

The world of banking and transactions is now at everyone’s fingertips. And so, we at Samata, have also brought the same ease and convenience for our customers. Presenting Samata Mobile Banking App - from deposits to fund transfers like RTGS, IMPS and NEFT to downloading statements, everything is now just a click away, on your phone.

Samata Mobile Banking App is now available on Playstore.

MOBILE BANKING MADE EASIER!

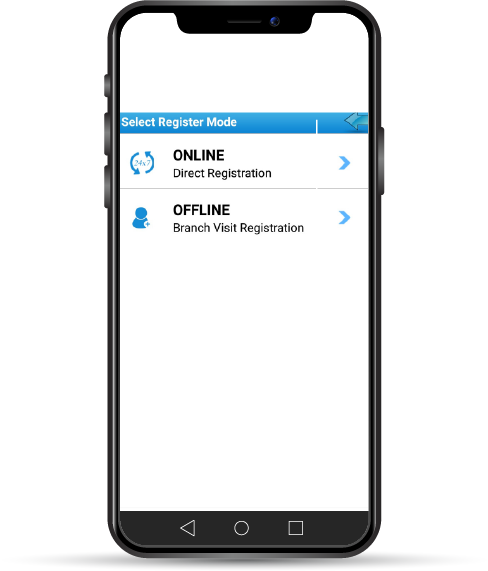

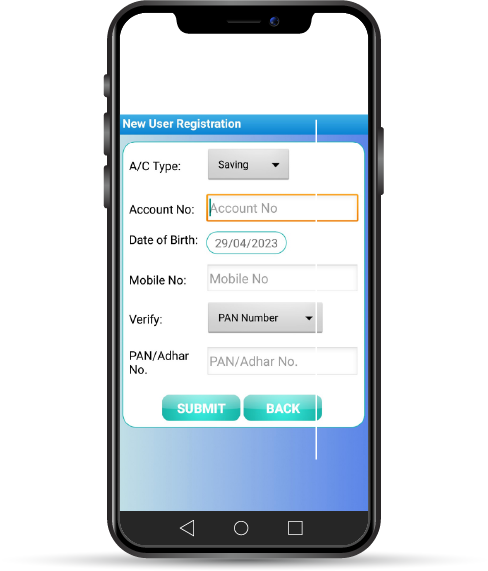

4 Simple steps to use Samata Mobile Banking App

MONEY TRANSFER

As online transactions continue to rise exponentially, people need easier and trusted ways to transfer money online. Digital frauds make everyone a bit more skeptical about using online transfer gateways. In this scenario, Samata provides the rusted solution.

It brings to its customers a simple interface that further simplifies online money transfer for them. The Samata Money Transfer solutions supports all types of online transfers - namely RTGS, IMPS and NEFT. With a secure gateway and easy-to-use navigation system, the Samata Money Transfer service is used by a lot of customers already, and the number of users continues to rise.

NEFT

RTGS

IMPS

Locker Facility

People own lots of assets, including gold and jewellery, which comes from their hard-earned money. But keeping them at home can both be a security risk due to robberies or a safety issue due to natural calamities. In such a scenario, the wiser thing to do is to keep the valuables in the safe lockers at Samata.

Available at most of our branches, the locker facility is ideal to keep your jewellery, documents and other crucial valuables.

Features of locker facility

- Fully air-conditioned state-of-the-art lockers

- Fully equipped with latest burglar alarm systems

- Available in different sizes as per your requirement

- For additional safety, the locker holder assigns a passcode

- The lockers can be nominated to your family or friends

| Location | Address | Contact |

|---|---|---|

| Kopargaon | Samata Marg, Khandaknala, Kopargaon | +91 80 5511 9152 |

| Gandhi Chowk | Gandhi Chowk, Kopargaon | +91 80 5511 9159 |

| Surya Complex | Surya Complex, Kopargaon | +91 80 5511 9782 |

| Rahata | Shree Chatrapati Shivaji Maharaj Sankul, Shivaji Chowk, Rahata | +91 80 5511 9154 |

| Shrirampur | Kishor Cineflex, Shivaji Road, Shrirampur | +91 80 5511 9156 |

| Yeola | Fatteburuj Naka, Near Jangali Maharaj Kaman, Yeola | +91 80 5511 9157 |

| Rahuri | Raman Pushp Complex, Opp. Bus Stand, Nagar-Manmad Road, Rahuri | +91 80 5511 9163 |

| Vaijapur | Thakkar Bazaar Complex, Old ST Bus Stand, Vaijapur | +91 80 5511 9162 |

MICRO ATM

While digital transactions are on the rise, the need for cash is never going to go away. And at that point, having easy access to a cash withdrawal system becomes crucial. To add convenience to the everyday life of people, Samata has introduced Micro ATM facility for the first time. It will allow people to withdraw money from any of its branches using a Debit Card.

Features of Micro ATM

- Makes money withdrawal easier in remote locations

- Supports digitization of rural banking

- It is biometric enabled for safety and security

- Supports multiple languages for customer’s convenience

PAPERLESS BANKING

As an environmentally responsible organisation, Samata believes in providing sustainable solutions. As a part of this philosophy, we have migrated extensively to paperless banking through multiple steps, across our operations.

Features of Paperless Banking

- Electronic transactions (NEFT/RTGS/IMPS)

- Providing digitally downloadable account statements

- Online payments and deposits