ABOUT SAMATA

How our journey started…

11 May 1986… A day that remains close to our hearts as on a simple, sunny morning, our dreams put a big step forward. In a small 10 feet by 15 feet space on Kopargaon’s Shivaji Road, Samata Patasanstha started its journey. A capital of Rs. 1 Lakh, deposits of trust worth Rs. 3 Lakh and 700 members who gave us our foundation - that’s what we started with. Powered by the principles of co-operative, Samata built deposits worth Rs. 1 Cr., in a short time.

Samata continued to grow under the visionary leadership of its Chairman - Shri. Kakasaheb Koyate. Today, we have built connections with 1,00,000+ people through our 20 branches and 23 gold loan counters. Samata has proudly crossed deposits worth Rs. 1,000 Cr. and gold loans worth Rs. 600 Cr. have empowered many dreams.

We have always overcome challenges through belief in our values. The negative propaganda of 2006, the floods of 2009, the demonetisation of 2016 and the pandemic of 2020 couldn’t hinder our progress.

Samata is proud to be Maharashtra’s first credit co-operative society that publishes an annual budget on 31st March of every year. By leveraging technology, we have added services like mobile banking, core banking, UPI, paperless banking and e-documentation to our portfolio.

Deposits of 99.93% depositors up to Rs. 55 Lakh have been secured under Liquidity Protection Fund. A special interest rate for women depositors, a pension scheme for the senior citizens, loans at lower interest rates for the farmers, special deposit schemes for the kids and continuous support to women self help groups - Samata fulfills its responsibilities towards the society through many such initiatives.

By actively supporting many social causes, Samata has earned the trust of lakhs of people and built a reputation of putting people’s interest first, always.

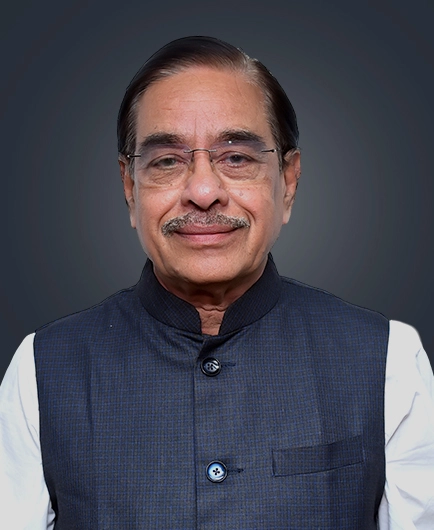

OMPRAKAASH DADAPPA A.K.A. KAKA KOYATE

Founder & Chairman

Samata Civil Credit Cooperative Society

Chairman

Maharashtra State Cooperative Societies Federation

Treasurer

Asian Confederation Credit Union

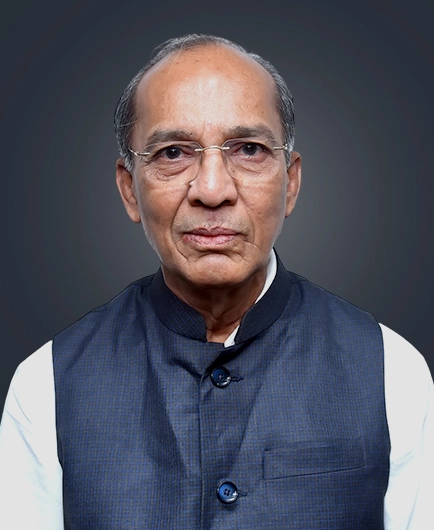

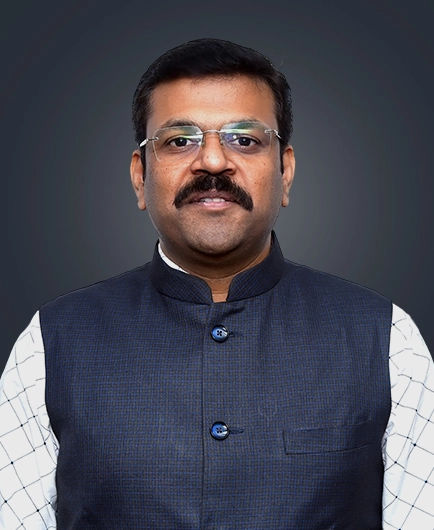

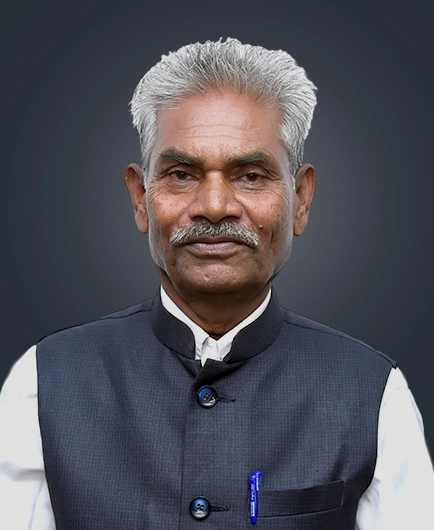

BOARD OF DIRECTORS

OUR MISSION

Transparent, trustworthy services focused on members

Using new technology to make banking simpler and faster for everyone while also contributing to the to everyone’s growth by fulfilling our social commitments.

OUR VISION

Making Samata the trusted source of financial prosperity

Making modern and secure services reach the common man in the easiest manner, and nurturing social and financial growth through the co-operative movement.

FINANCIAL SCENARIO

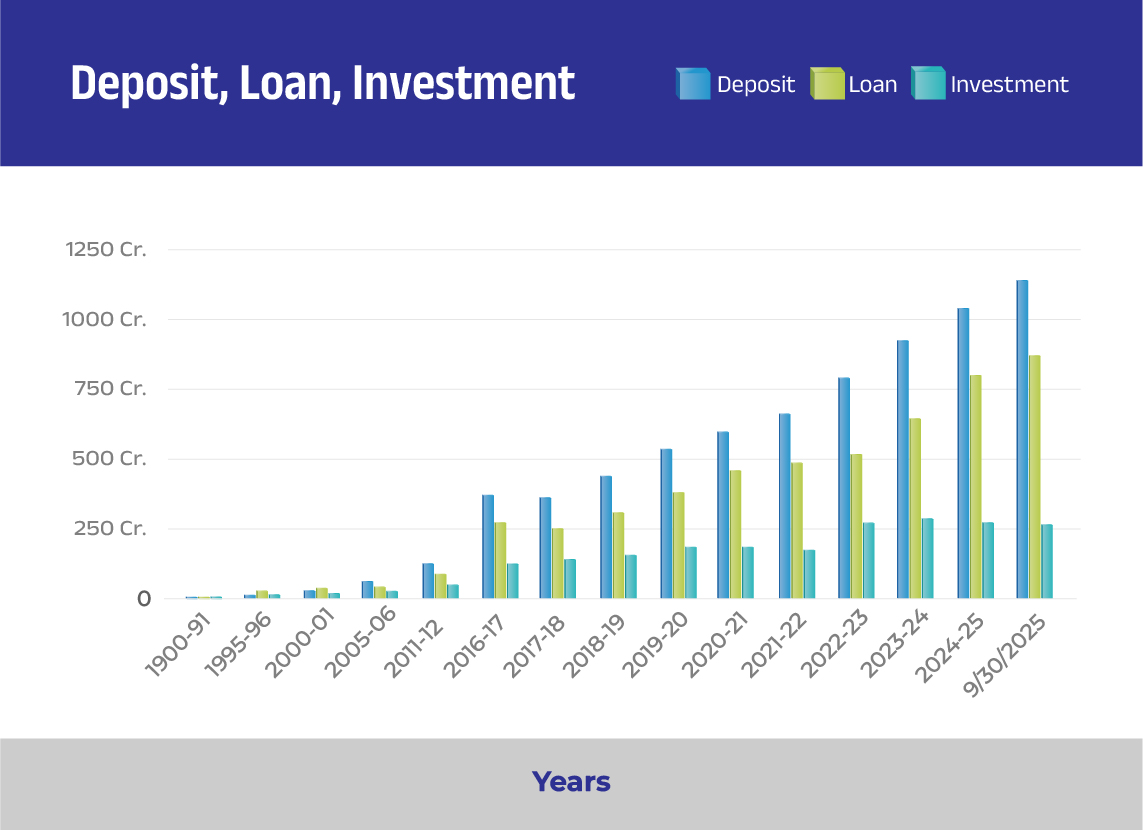

| Years | Member | Deposits (Amounts in rupees) | Loan | Gold Loan | Investment | Audit Group |

|---|---|---|---|---|---|---|

| 1900-91 | 1,315 | 35,92,767 | 36,48,035 | - | 4,95,500 | "A" |

| 1995-96 | 1,315 | 2,76,55,391 | 25,70,14,329 | - | 4,691,350 | "A" |

| 2000-01 | 1,315 | 22,16,11,850 | 14,83,04,900 | - | 5,60,07,600 | "A" |

| 2005-06 | 1,315 | 57,11,44,023 | 39,83,24,910 | - | 21,86,62,270 | "A" |

| 2011-12 | 1,315 | 12,42,087,840 | 89,12,19,462 | - | 46,05,51,655 | "A" |

| 2016-17 | 10,779 | 3,72,26,94,841 | 2,68,61,46,769 | 3,14,18,891 | 1,21,35,08,555 | "A" |

| 2017-18 | 17,398 | 3,63,13,35,415 | 2,45,26,13,955 | 6,96,40,136 | 1,41,02,17,774 | "A" |

| 2018-19 | 30,996 | 4,33,23,83,025 | 3,00,89,80,275 | 12,25,66,861 | 1,60,71,41,729 | "A" |

| 2019-20 | 48,014 | 5,32,39,08,274 | 3,78,62,69,793 | 40,22,06,099 | 1,76,63,82,584 | "A" |

| 2020-21 | 56,758 | 6,00,02,64,247 | 4,54,44,37,362 | 93,41,71,785 | 1,76,13,70,812 | "A" |

| 2021-22 | 66,442 | 6,61,47,56,639 | 4,82,42,55,117 | 1,71,84,62,404 | 1,74,15,20,436 | "A" |

| 2022-23 | 77,178 | 7,91,93,87,535 | 5,14,26,10,425 | 2,38,17,32,747 | 2,70,28,17,734 | "A" |

| 2023-24 | 87,537 | 9,23,65,97,799 | 6,42,42,51,768 | 3,53,56,63,144 | 2,79,92,40,785 | "A" |

| 2024-25 | 97,349 | 10,36,79,91,838 | 7,95,53,65,385 | 4,98,91,59,067 | 2,70,82,96,998 | “A” |

| 9/30/2025 | 1,01,643 | 11,39,25,14,030.12 | 8,67,04,85,122 | 6,08,19,96,366 | 2,59,94,75,186 |